Why Insurance is Epoch-making for used cars in Guatemala

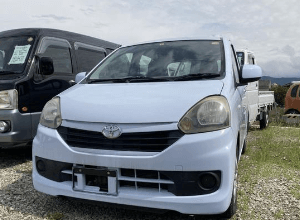

Buying a car is no doubt a big financial decision. If it is a used car, then you must go a long way from selecting to buying and all the necessary inspections of it. If it is a good-condition vehicle at an affordable price, then there should be a commendation for closing a great deal. Choose a perfect vehicle from the ocean of Japanese used cars for sale in Guatemala.

The need of Insurance

But the journey does not end here; a most crucial step still needs to be completed. The insurance of the car. Wondering why it is such a crucial step, let SAT Japan clarify this confusion (if you have any).

A legal requirement:

Insurance is sometimes not just a personal choice; in many regions like Australia, the insurance of your car is compulsory. Especially when it is a used car, then having its insurance is legally crucial. If you don’t have vehicle insurance, you must end up paying fines or any legal charges.

Financial protection:

Insurance is basically not to burden you financially, but it’s basically freeing you from the financial worries of your vehicle. Insurance offers protection from the cost of replacement or repairs in any misshape to your car. If your car is stolen or destroyed in any accident, you don’t have to get worried if your car has insurance. If you didn’t have insurance, you would have to pay for these costs, which may add up, it become more if you drive a secondhand car).

See also: Different methods to watch Instagram stories anonymously

Liability coverage:

Insurance is not always helpful for just getting coverage for your car damage. The good thing is that it also provides liability insurance. So, if you accidentally damage someone else’s property or cause any damage to your vehicle, it can be covered by the insurance (Woohoo).

Just think of it: if you don’t have insurance and an accident happens, it is the least desirable thinking I know. This accident causes damage not only to your vehicle but also to someone else’s property. Now imagine the cost of repairing you have to bear. You indeed drive confidently, knowing that you are covered financially if something accident occurs to your car if you have insurance, but in the perks of the insurance, don’t forget to drive safely and carefully.

How to choose the insurance.

Assess your needs and preferences:

Not all insurance is for everyone and every car. You need to set your preferences and needs of what kind of insurance suits you the most. For this, you need to consider the age and condition of the vehicle. The buffet of insurance is one of the most critical factors. Carefully plan the insurance depending on your income and financial sources.

Type of coverage:

Before getting your insurance, you must understand the types of insurance and the available options for you; here are some of the common vehicle insurance types.

Third-party Insurance:

An insurance type that covers the minimum legal requirement covers the damage to your property and damages to the other property you caused accidentally.

Comprehensive insurance.

The type of insurance that provides the most extensive coverage or covers the major chunk of any damage. This includes the coverage of your vehicle, as well as the damage to the other’s property done because of you.

Compare quotes

Look around and evaluate quotes from several insurance companies to get the finest protection at the most affordable cost. Take into account elements including the extent of coverage, deductibles, exclusions, and any other advantages or savings that each insurance may provide.

Make sure to get your insurance on time so you can freely drive and enjoy the experience of your new vehicle.